Here for your interests

We’re here to support you—and that’s it.

- We sell no financial products.

- We receive no commissions.

- We are entirely independent and employee-owned.

Since our founding in 2000, we have served clients as a fiduciary. As a Registered Investment Advisor, we are compensated for our services based on client assets under management, which aligns our interest with yours. Our fees grow as your assets grow.

Our services include customized investment management, model portfolios, financial planning and intergenerational & survivorship guidance.

Expect understanding

We want you to understand your financial situation—and our counsel to further it. We make easy-going conversation our mode of communication from the beginning … and keep it that way.

You can expect one or more initial meetings to gather financial information. We’ll build a financial plan and make recommendations for investment allocations. This holistic process works best when you engage us to advise across your investable assets. If you decide to go forward, we’ll implement the investment plan on your behalf.

Once the plan and portfolio allocations are in place, we revisit both regularly. In addition, clients regularly seek our input on topics that could impact their financial plan. Whether a topic is straightforward or complex, we work to get to the heart of the matter and will talk with you plainly.

The same is true for investing. Success is gained over time. That requires staying with a plan—and for staying power, there’s no substitute for understanding.

We promise honesty, transparency and exceptional client service

We work for strong, lasting relationships based on trust.

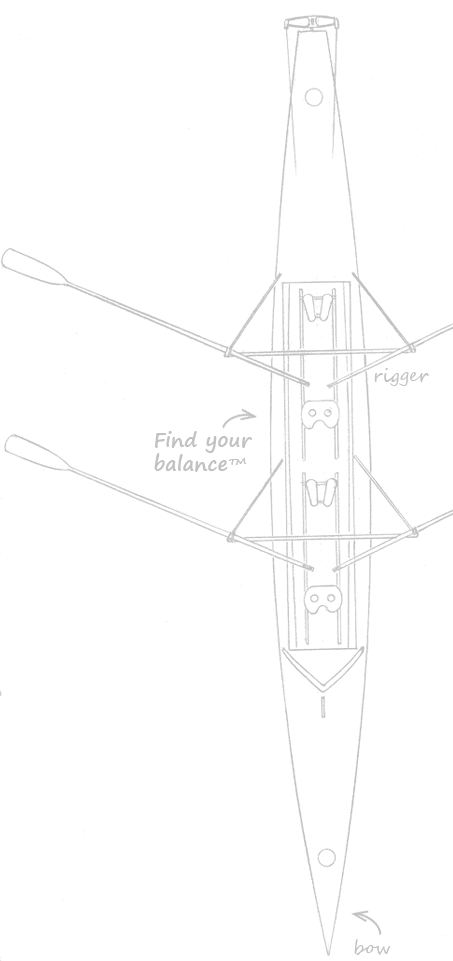

About Our Name

The mindset of a successful rower—an oarsman—is our inspiration.

Rowers hold to their form. They strive for strength and poise regardless of:

- Water that’s flat or choppy

- Wind that’s for or against them

- Where they are in a race

Rowers pull together. Success requires:

- Shared dedication

- A solid game plan

- Relentless pursuit of balance

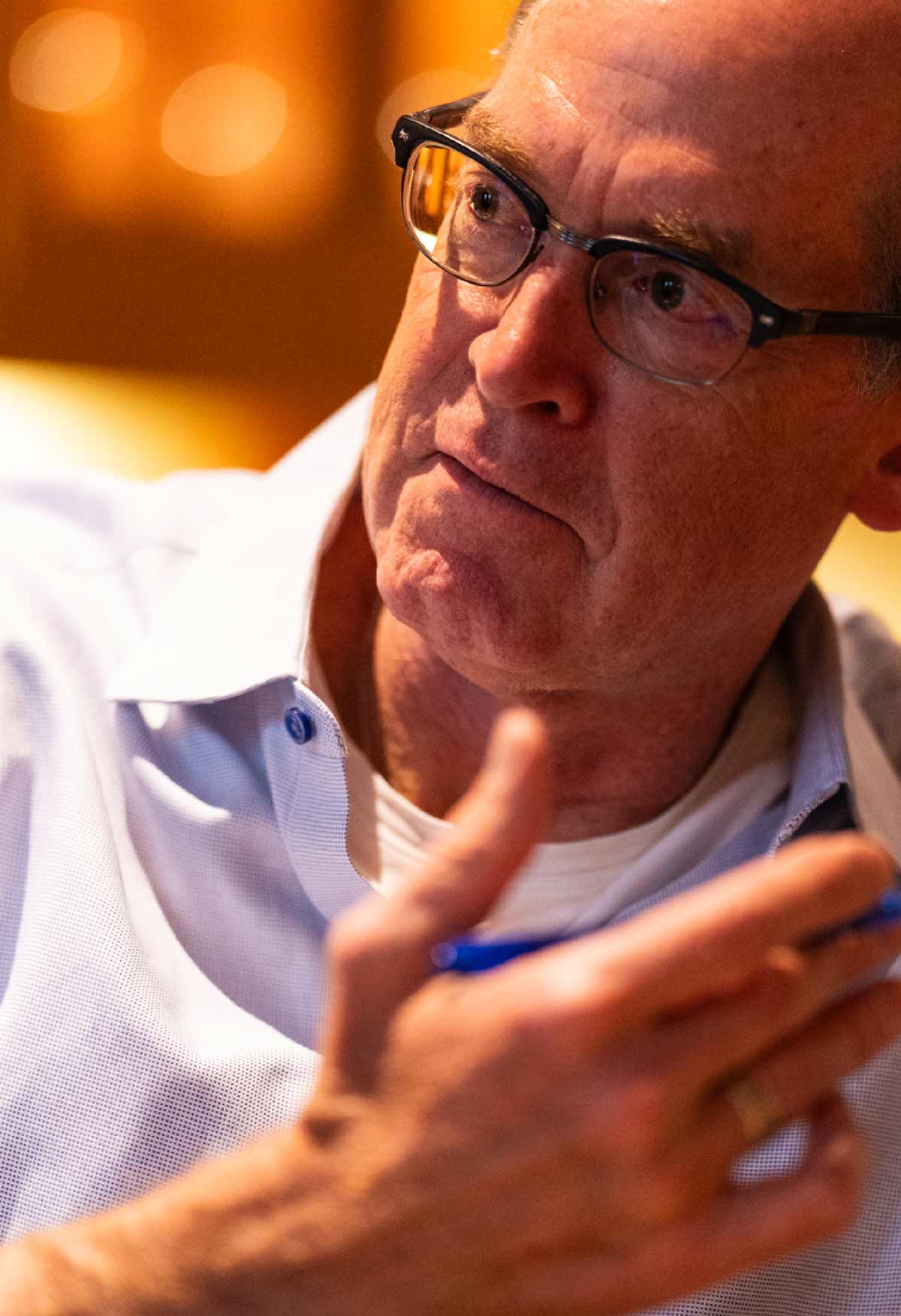

Co-founder and competitive rower Bob Phelps leads the Oarsman team.