3Q 2025 Review and Outlook

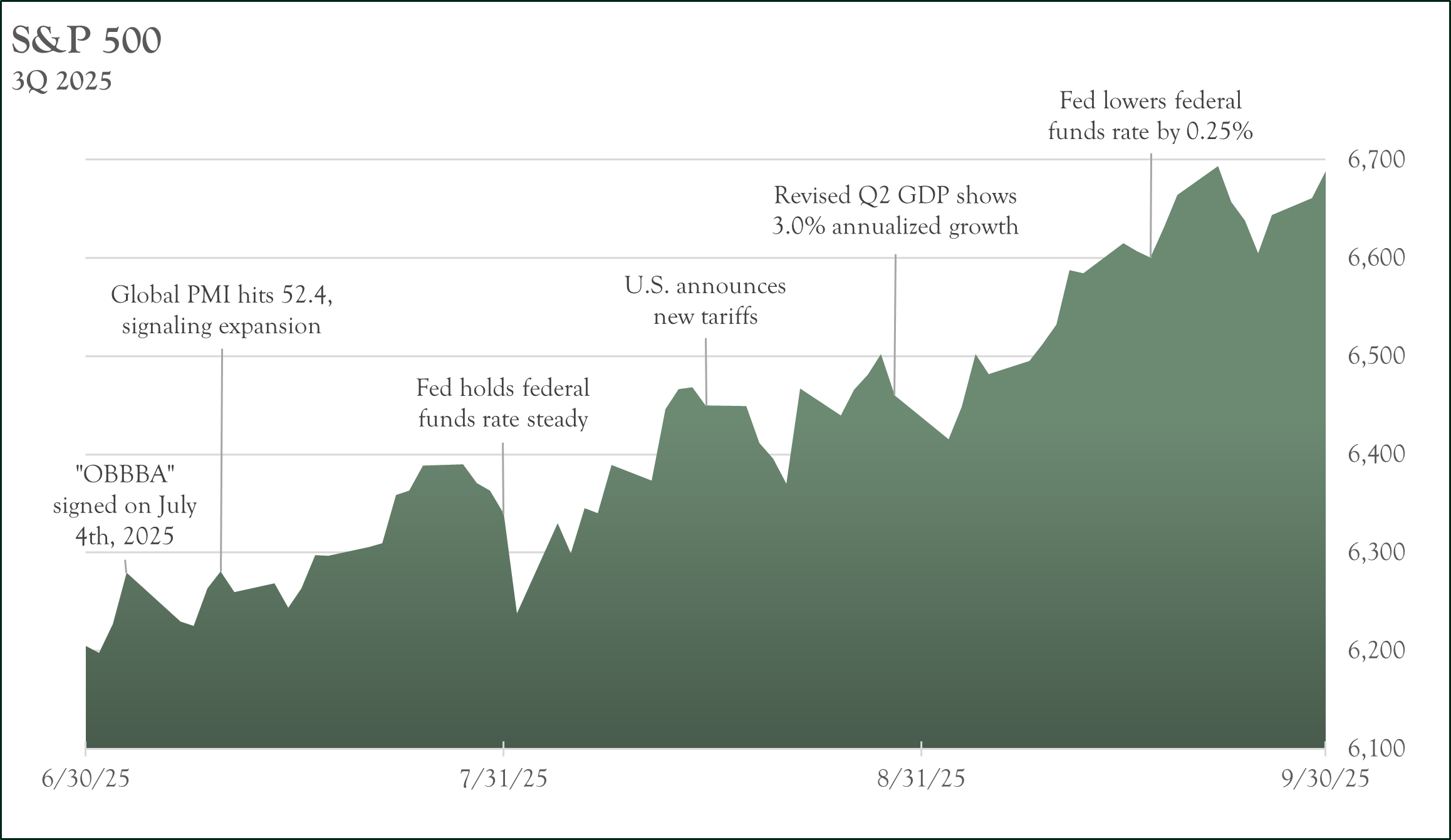

Equity markets extended their strong performance in the third quarter, delivering broad-based gains with the S&P 500 rising more than 8% and bringing its year-to-date return to an impressive 14.8%. This rally was fueled by easing tariff tensions and growing investor confidence that the Federal Reserve would cut short-term interest rates in response to cooling inflation or any signs of weakness in the U.S. labor market.

The top-performing S&P 500 sectors were Information Technology, Consumer Discretionary, and Financials. In contrast, the Energy and Healthcare sectors lagged, with both sectors ending in negative territory.

Small-cap stocks outpaced their large-cap counterparts, gaining 9% for the quarter. Investors were optimistic that smaller companies would benefit more from a lower interest rate environment. International equities also maintained momentum, with both developed and emerging markets posting gains. Notably, emerging markets surged 10.6%, making them the top-performing major equity asset class.

Fixed income returns were positive across the board, as interest rates declined for both short- and long-term maturities—boosting bond prices due to their inverse relationship with rates. Meanwhile, gold continued its historic run, climbing another 17% and reinforcing its role as a global safe-haven asset in uncertain times.

What drove the stock market?

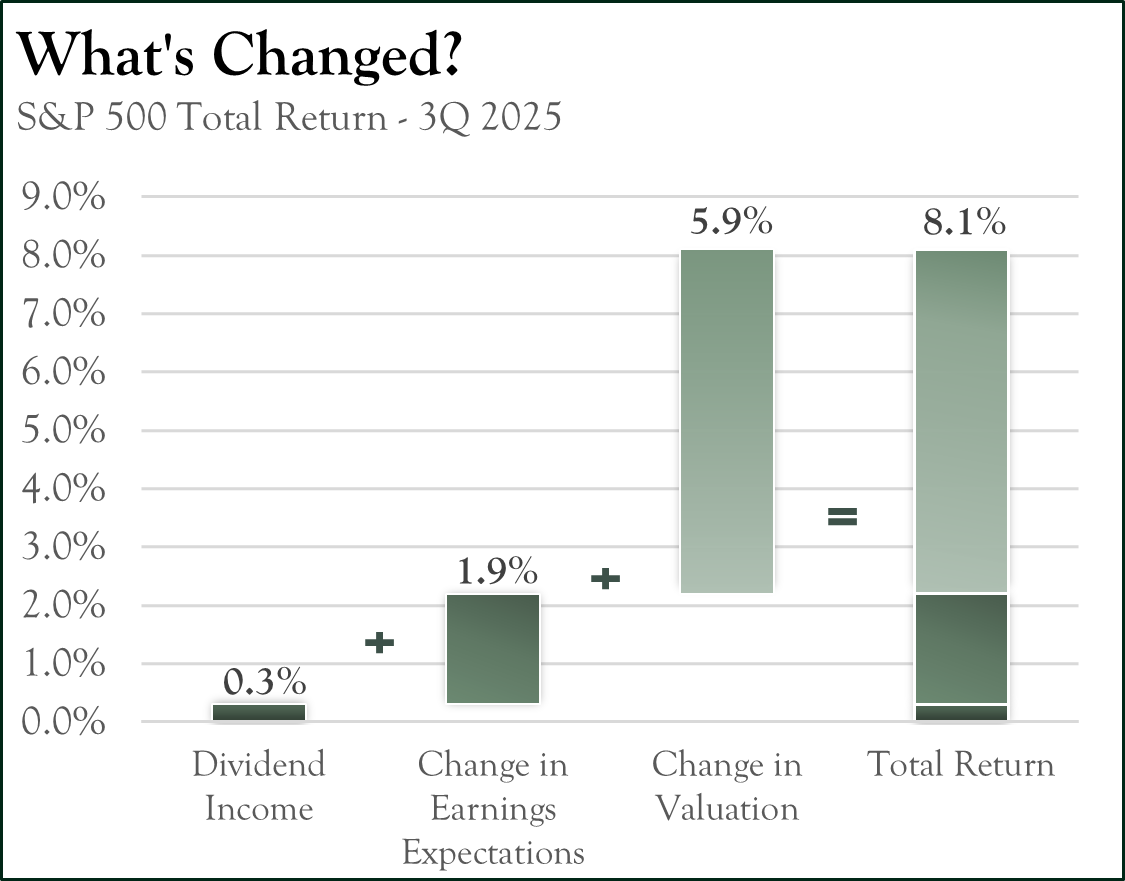

“What’s Changed?” is a simple explanation of what happened in S&P 500 during the most recent period but does not necessarily explain why the market moved. Let’s explore the “why” by looking at three individual components that shape market changes.

Dividend Yield:

The most stable of the three factors as corporations resist cutting their dividend except in the most extreme cases. Dividend yields were approximately +0.3% this quarter.

Change in Earnings Expectations:

Over the long term, earnings drive stock prices. This quarter, earnings expectations for the next 12 months rose by +1.9%, continuing the recent trend. Benefits from the tax bill signed on July 4th helped drive upward revisions in earnings and was enough to bolster more confidence in the U.S. economy’s ability to weather turbulence from tariffs, increasing debt and geopolitical uncertainty.

Change in Valuation (Price/Earnings ratio):

The earnings growth of 3Q, along with the accompanying positive sentiment, sent valuations higher during the quarter. For this report, we measure change in valuation by observing the Price-to-earnings (P/E) ratio. This quarter, the P/E ratio responded to the improving sentiment, expanding by 5.9%, after beginning the quarter at roughly 21.5 times earnings. The optimism may well have been warranted, but at 22.8 times earnings, we will need earnings to materialize in order to justify higher stock prices.

What drove the bond market?

The benchmark 2-year Treasury rate decreased to 3.6% on September 30th from 3.7% at the beginning of the quarter. During the same period, the benchmark 10-year Treasury decreased below 4.2%, or 8 basis points from the June 30th rate.

At the September meeting, the Federal Reserve cut rates for the first time this year, resuming the rate cutting cycle that began in 2024. Federal Reserve Chair Jerome Powell signaled a cautious approach to further decreases. The market, however, is now pricing in two additional 0.25% cuts based on the spread between the Federal Funds Rate (currently at 4.1%) and the 2-year Treasury (currently 3.6%). The basis for being less restrictive is that inflation, while not at the Fed’s target rate, appears to be cooling while the jobs data may be indicating some softness in the labor market (a co-equal directive of the Fed’s dual mandate).

The Federal Reserve cut its benchmark interest rate twice in the quarter, lowering the Federal Funds rate to a range of 4.25 to 4.50 percent. Despite the Fed cutting short-term rates, however, the yield on the 10-Year Treasury rose from 3.8 percent to over 4.5 percent. There are several possible explanations for this upward move. To begin, inflation has remained stubbornly above the Fed’s target of 2.0 percent. Fed Chairman Jerome Powell has stated that the Committee is closely watching for signs that inflation could be re-accelerating. Higher inflation in the economy has an upward bias on interest rates and rates drifting higher could be an indication that the market is pricing in this possibility. If that is the case, the Fed would be forced to pause (or possibly reverse) their current rate-cutting cycle. Another possible explanation is the incoming administration’s focus on lowering taxes and deregulation - both potentially expansionary policies. The re-rating of growth expectations upward translates into higher long-term interest rates as bonds are sold (lower price, higher yield) in favor of higher return-potential equities. Either reason, or a combination of the two, leads to higher rates in the future.

Outlook

The third quarter saw continued equity outperformance from the second quarter nadir. In fact, the low for the quarter was set on the first day of trading in July. With an increase in market prices came an increase in headlines pointing to the exuberance of the market. Many commentators are now arguing that new highs in the S&P 500, elevated price-to-earnings multiples (the index currently near 23 times), and record setting price-to-sales valuations (3.33 times, double the 35-year average) are all reasons to sell the market (Source: Bespoke[1], Bloomberg). Despite these historically elevated valuations, however, we see few reasons for this rally to reverse in the fourth quarter.

To begin, signing “An Act to Provide for Reconciliation Pursuant to Title II of H. Con. Res. 14”, colloquially named OBBBA, has laid the groundwork for further gains. In addition to permanent extensions to parts of the Tax Cuts and Jobs Act of 2017, the bill has provided numerous growth-oriented incentives for corporations to bring manufacturing back to the U.S. and re-engineer supply chains around the world. Among the corporate benefits are deductions for depreciation on qualified production property, as well as deductions for domestic research expenditures. These incentives were designed to drive corporations to build new production and R&D facilities within the U.S. And we have seen early signs of success as several announcements have already been made. It remains to be seen how much automation will be incorporated into these developments or whether they will be fully staffed with high-paying jobs but for now, construction and associated capital expenditures are booming.

While these government programs do incur a cost (in the form of larger fiscal deficits), we are beginning to see positive effects of the administration’s trade policy. Market sentiment changed markedly during the quarter as trade negotiations turned into trade deals, albeit with tariff rates higher than at any point since the 1940s. Notably, importers have not been passing the full tariff increase on to consumers but instead, finding more “creative” ways to share the burden. The result is slightly higher prices (not inflationary shocks) and, more importantly, the U.S. Treasury raising cash at a rate of roughly $20 billion per month. The net effect is that tariff revenue is helping to offset much of the pro-growth policy cost. This has sidelined many of the concerns about runaway debt and deficits. And, if the tariffs remain in place, the benefits are expected to increase next year. According to Strategas[2], “…corporate and consumer tax cuts and spending credits will supplement more than $515 [billion] of consumer tax refunds coming next Spring…” (Quarterly Review in Charts - 3Q 2025). This is the equivalent of an increase of approximately $1,000 in tax returns next year, bolstering the consumer; an important factor considering the cracks that are beginning to show on individuals’ balance sheets. Increased income could sustain the consumer and the economy until some of the other benefits are fully realized.

While the fiscal spending of the government is important, monetary policy is also playing a role. Loosening monetary policy (as the Fed lowers rates impacting the short end) should help many businesses that have been dealing with higher financing costs since the Fed’s rate hiking cycle in 2022. Market participants are now following an old playbook, “Don’t Fight the Fed,” and are fueling a risk-on rally. Of course, this could lead to an over-heating economy which would require the Fed to reverse policy and raise interest rates. However, we do not see that outcome as likely over the short-term. Federal Reserve Chairman Jerome Powell’s term is scheduled to end in May of 2026 giving the President the opportunity to appoint a more dovish chairman (with the Senate’s confirmation). Therefore, it appears that a lower rate regime is on the way, albeit more delayed than some would prefer. Either way, these developments have eased market fears, adding greater clarity to the current administration’s longer-term plan and supplementing the market with greater liquidity - a potent combination.

While semiconductor companies like Nvidia (NVDA) and Broadcom (AVGO) have garnered a majority of the attention, there are other real businesses selling real products and generating real earnings. Critically, we are starting to see non-AI related companies flexing their might. From industrial companies building physical infrastructure to financials sponsoring mergers and acquisitions (M&A), the beneficiaries in this market are broadening; a positive development from the narrow performance of a few names we saw over the last couple of quarters. Technology is certainly an important sector but it is financials and industrials that make up a larger portion of the mid-cap and small-cap indices. It is now time to look down the market capitalization spectrum for names that could steal attention (and dollars) away from the Magnificent Seven of the past. Additionally, M&A activity is expected to continue if stock prices remain high (making their currency more valuable) and interest rates drop (making financing cheaper). The result would be capital flowing to other parts of the market.

International markets are also a beneficiary of the broadening trade. International markets were generally up during the quarter and adding to their year-to-date performance over the U.S. market. (Emerging markets outpacing both domestic and international developed markets.) Much of the move can be attributed to a depreciating dollar, making financing of dollar-based assets more attractive (think commodities priced in dollars). However, a consistent theme is building in these markets as cyclical stocks are starting to perk up after years of underperformance. The technology behind artificial intelligence may be emanating from the U.S., but countries and companies around the world are building the infrastructure required for the increased computing. From energy to real estate, international companies are beginning to show promise. Whether this is simple mean-reverse after years of underperformance or true outperformance will be crucial to decipher. We continue to hold international equities and look for opportunities to increase the allocation for our client’s portfolios.

As presented in previous letters, we look to the bond market for confirmation of the equity market’s rally. Unlike equity investors, bond investors are not interested in the hopes and dreams that many companies sell. The bond market’s concern is the return of capital (rather than the return on capital). “Risk” of a bond is usually assessed by how much an investor requires in excess of some risk-free rate (usually a U.S. Treasury). Today, investment-grade bond market participants require less than 75 basis points (0.75%) of return over a Treasury; setting the low of the last 25 years. Essentially, investors are foregoing the “guaranteed” return of a Treasury and reaching for a (very) little extra yield despite the additional credit risk they are assuming. High yield investors were also showing remarkable “certainty” about their investments, requiring little premium for higher risk assets, around 265 basis points (2.65%) of additional yield. We see this development as confirmation of the equity rally as more rational (and potentially more discerning) investors are at ease - equity investors take note. We will continue to monitor the bond market for changes in sentiment but for now, the equity market believes it has a green light.

This is not to say there are no headwinds for this market; there are always areas of concern. Upside risks to inflation (while the Federal Reserve is in a rate-cutting cycle) remains top-of-mind for many after the shocks of the last couple of years. The unknown outcomes from levying tariffs on much of the world have investors and economists alike questioning their teachings and reworking their models. Unfortunately, only time will answer many of their questions. Additionally, the hype around AI has forced many of the largest companies in the market to plow much of their free cash flow into capital expenditures (free cash flow has been trending lower during this AI build-out). This is turning many capital light technology companies into more capital-intensive ventures as they build out physical infrastructure. Whether this is a long-term trend, or not, remains to be seen but consequences of this capital allocation change will largely depend on the fruitfulness of artificial intelligence. Once again, the bond market will inform our outlook if or when investors begin to question the security of their income stream.

In our last letter, we wrote, “…easing of monetary conditions, coupled with the pending liquidity provided by the budget bill are a cocktail… with an added shot of deregulation… All of this points to continued ‘risk-on’ positioning within the market.” We echo a similar sentiment in this letter but always remind our readers that these conditions are also pre-requisites for asset bubbles. If it weren’t for America’s largest companies growing earnings at a double-digit rate despite the myriad headwinds they’ve faced over the last several years, we would probably err on the more conservative side. But operating margins for the S&P 500 over the next 12 months are expected to hit a decade high of 18.3%, according to Strategas. The skill of America’s corporations to deliver both in demand products and financial results is not to be underestimated. Of course, we will get another view into their world with 3Q earnings in the coming months.

Thank you for the continued trust you place in us. Enjoy the fall weather.

Your Oarsman Capital Team

[1] Bespoke Investment Group provides general financial market research related to equities, sectors, asset classes, and economics.

[2] Strategas Research Partners is a leading research firm focusing on macroeconomics, policy research and technical analysis.