2Q 2025 Review and Outlook

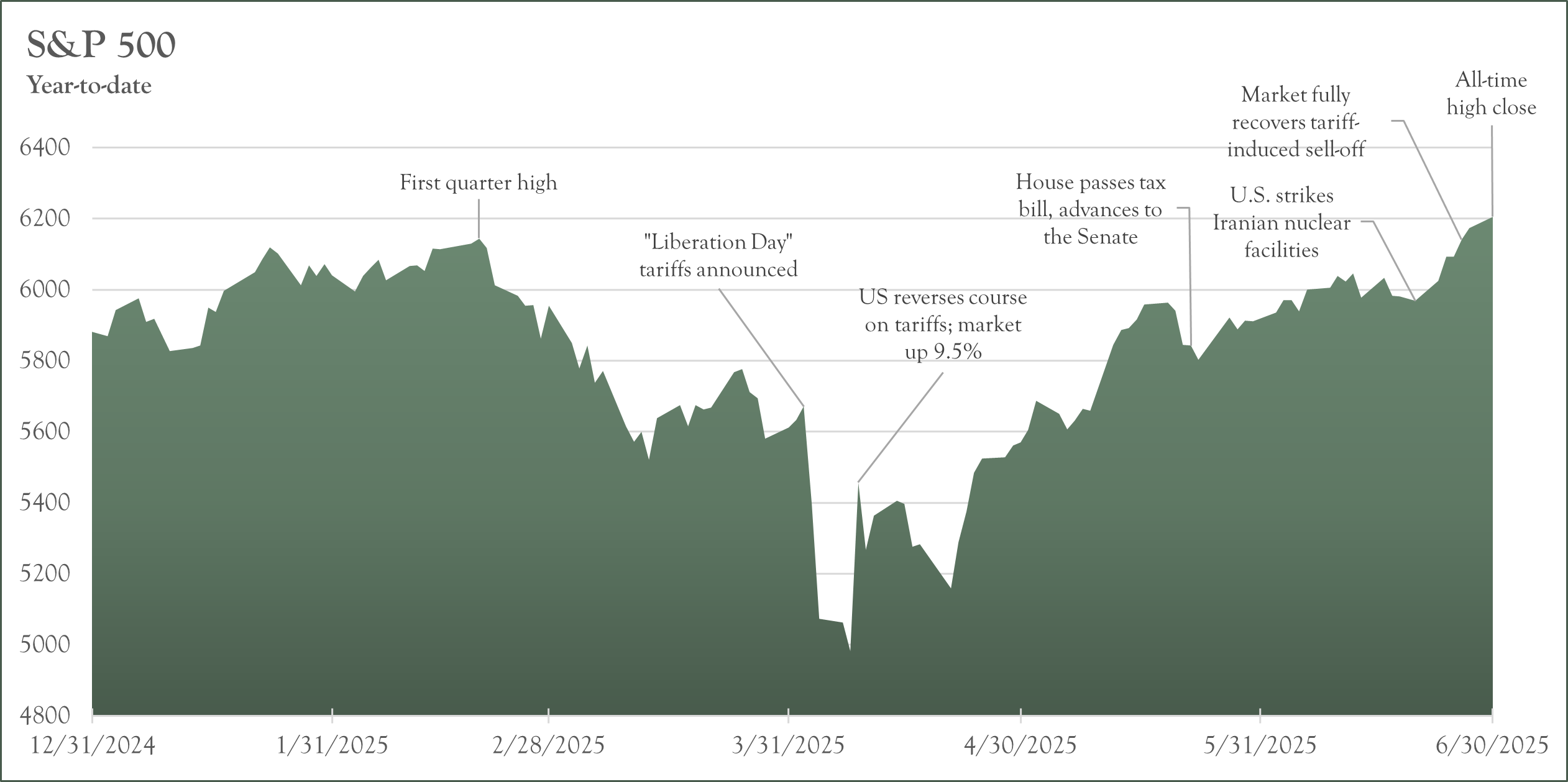

It was a volatile start to the second quarter as tariff talk sent the equity markets reeling, continuing the sell-off from the first quarter. The S&P 500 declined more than 11% in the first eight days of April, culminating in a nearly 20% decline from its mid-February all-time high. After a pivot on tariff policy, however, it took just 55 trading days for the S&P to recover losses and trade to a new all-time high. Quite remarkable.

Among U.S. large-cap sectors, Technology, Communication Services, and Utilities led with solid gains, while Energy and Consumer Discretionary lagged. Small-cap stocks, while positive for the quarter, lagged their large-cap counterparts. International markets, both developed and emerging, kept their winning streak alive, but failed to outperform U.S. large-cap stocks.

Fixed Income returns were mixed. The Bloomberg U.S. Aggregate Bond Index was up 1.2% while municipal bonds were generally unchanged. Broader commodities, including gold, took a pause amid lower inflation expectations.

What drove the stock market?

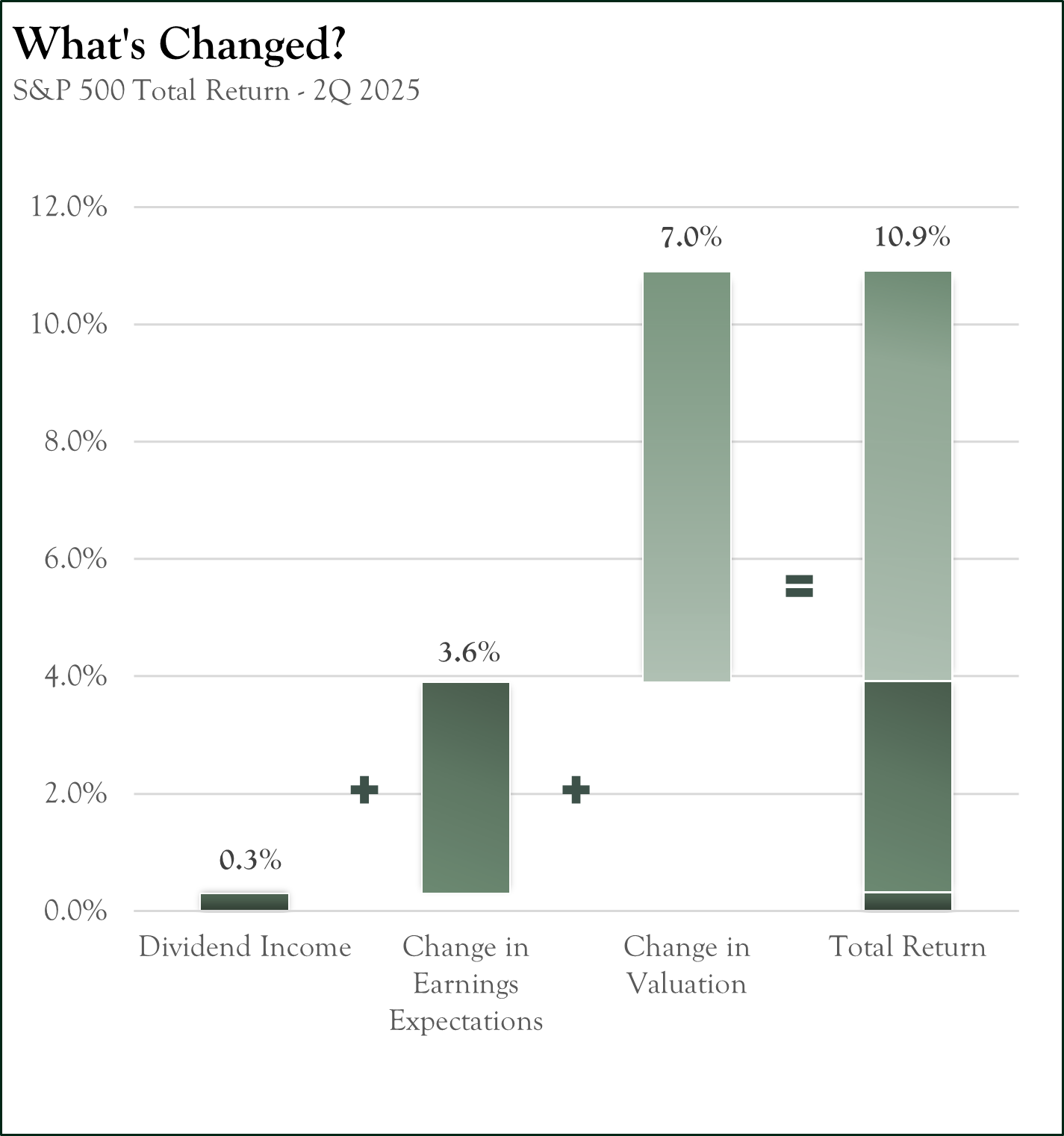

“What’s Changed?” is a simple explanation of what happened in S&P 500 during the most recent period but does not necessarily explain why the market moved. Let’s explore the “why” by looking at three individual components that shape market changes.

Dividend Yield:

The most stable of the three factors as corporations resist cutting their dividend except in the most extreme cases. Dividend yields were approximately +0.3% this quarter.

Change in Earnings Expectations:

Over the long term, earnings drive stock prices. This quarter, earnings expectations for the next 12 months rose by +3.6%, continuing the trend of positive changes. Despite ending the quarter with a surge, the quarter started with a series of signficant downward revisions in earnings expectations. Stock market prices followed suit with a plunge in early April. Tariff fears subsided somewhat as the worst-case scenarios came off the table and negotiations were pushed down the road. This led to a reconsideration of earnings, mostly higher. The remainder of 2025 continues to look buoyant with earnings growth looking very healthy over 2024 earnings.

Change in Valuation (Price/Earnings ratio):

The Price/Earnings (P/E) ratio measures how investors value a company’s earnings. Over longer periods (spanning multiple quarters or years), a rising P/E ratio generally aligns with rising earnings. After contracting along with earnings in the early days of the quarter, the P/E ratio rebounded and ended nearly +7.0% higher. We began at roughly 20.2 times earnings and ended at 21.6 times. We are back in a world of relatively high optimism.

What drove the bond market?

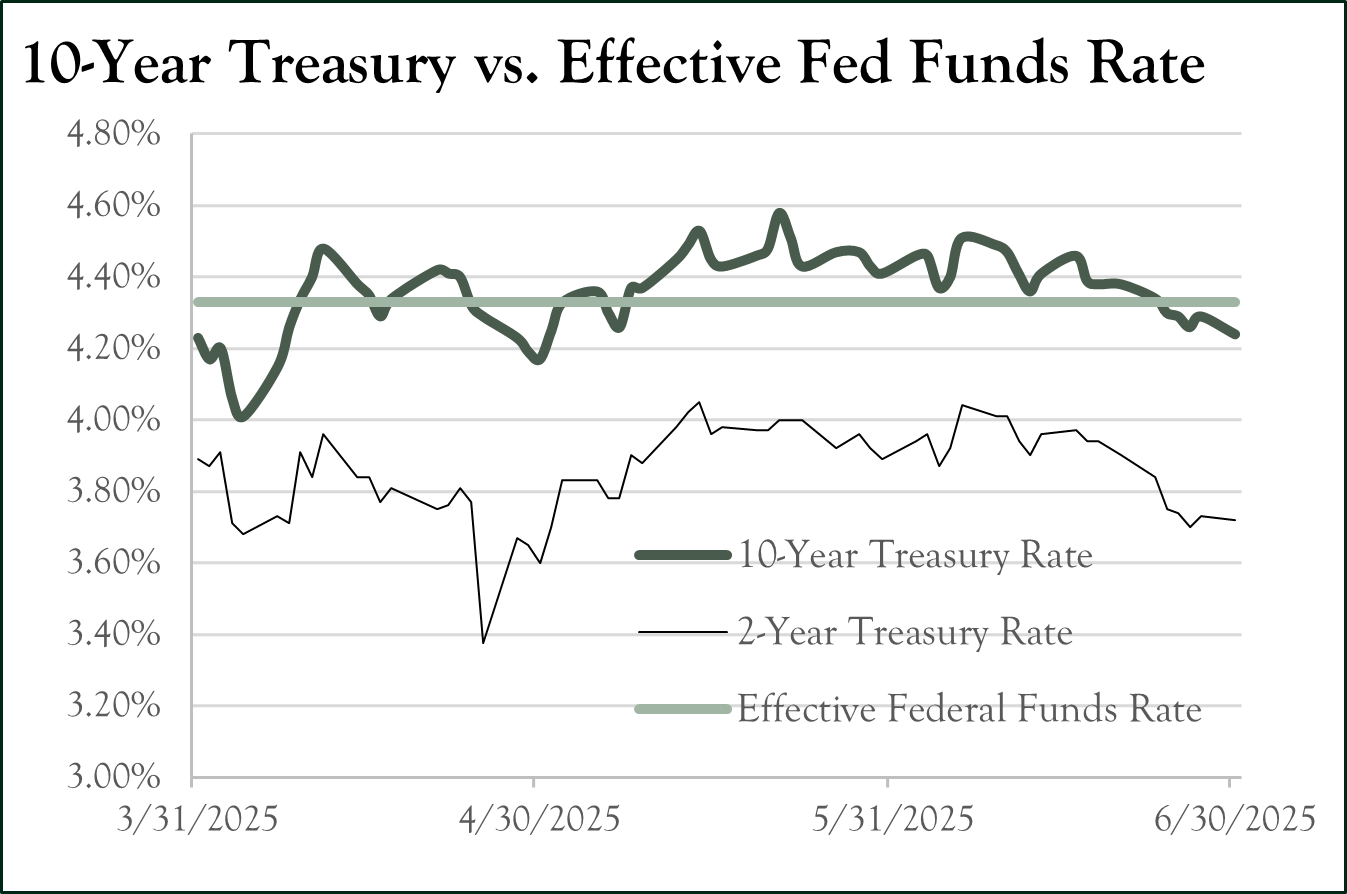

While the Federal Reserve remained “on-hold” during the second quarter, the two-year Treasury yield continued to drift lower, implying rate cuts are still on the horizon, albeit delayed from earlier expectations. Investors saw virtually no change in the 10-year Treasury Note that ended the quarter with a yield of 4.23%. This resulted in a steeper 2/10 spread, which is a positive development for the market as investors are beginning to be compensated more for lending over longer periods of time.

The latest Summary of Economic Projections (SEP) states that Fed members expect rates to be cut twice before the end of 2025 and once in 2026 (contrasting with the futures market which expects more cutting in 2026).

The Federal Reserve cut its benchmark interest rate twice in the quarter, lowering the Federal Funds rate to a range of 4.25 to 4.50 percent. Despite the Fed cutting short-term rates, however, the yield on the 10-Year Treasury rose from 3.8 percent to over 4.5 percent. There are several possible explanations for this upward move. To begin, inflation has remained stubbornly above the Fed’s target of 2.0 percent. Fed Chairman Jerome Powell has stated that the Committee is closely watching for signs that inflation could be re-accelerating. Higher inflation in the economy has an upward bias on interest rates and rates drifting higher could be an indication that the market is pricing in this possibility. If that is the case, the Fed would be forced to pause (or possibly reverse) their current rate-cutting cycle. Another possible explanation is the incoming administration’s focus on lowering taxes and deregulation - both potentially expansionary policies. The re-rating of growth expectations upward translates into higher long-term interest rates as bonds are sold (lower price, higher yield) in favor of higher return-potential equities. Either reason, or a combination of the two, leads to higher rates in the future.

Outlook

After a powerful rally from the April 8th low, the S&P 500 now trades at 21.6 times forward earnings – expensive from a historical perspective. The market climbed the “wall of worry,” powering through tariff-induced uncertainty, the U.S. being drawn into a conflict in the Middle East and a tax-cutting, deficit-spending budget bill. As we move into the third quarter, however, the consequences of the aforementioned issues remain front-and-center. With that in mind, it is important to remain focused on the underlying economy. While headlines can grab investor’s attention, fundamentals including gross domestic product (GDP), inflation readings, jobs numbers and consumer spending data remain the important factors for the health of this market.

Consensus GDP forecasts began to recover late in the quarter and now show growth picking up and accelerating throughout 2026, even if it is off a low base. While this could be a combination of negotiated rather than mandated tariffs or the impact of pro-growth policies in the budget bill, a pickup in GDP contradicts the narrative that we are headed for a recession. The Consumer Price Index (CPI), a widely watched economic indicator, shows inflation persistently above the Fed’s 2.0% target, with no clear trend towards that level. Many of the new policies have the potential to reignite inflation; something that may manifest itself in the near term. With economic growth in delicate balance, we are intently watching to see what occurs first: inflation returning to the Fed’s 2.0% target, or the effects of restrictive monetary policy beginning to take hold and unemployment picking up. In the first scenario, we would expect the Fed to cut rates and the stock market to resume its second quarter rally. In the second scenario, we would expect the rally to be on hold (or potentially unwound) as investors would fear a deteriorating economy. Unfortunately, the latter scenario would also likely cause the Fed to lower rates but for the wrong reasons.

Looking to the bond market for clues or confirmation of equity market trends, we currently see few reasons to worry. Investment grade and high yield option adjusted spreads (OAS) are near five-year lows, implying investors are not requiring extra compensation for holding riskier assets. Even more esoteric areas of the bond market like credit default swaps (think insurance on bonds), show little sign of fear as their falling “premiums” continue to trend downward. Given this outlook and within an environment of elevated short-term rates (at least over the near-term) and a slightly more positive slope to the yield curve, we continue to favor shorter term securities but are increasingly adding longer term bonds to lock in higher yields and hedge against falling rates.

Dropping rates can also have a positive impact on equities. Apart from the discounting of future cash flows with lower rates, it also incentivizes investors to seek higher returns away from bonds. As mentioned earlier, bond investors expect the Fed to cut rates (Fed Funds Futures currently price two 25 basis point cuts by the end of the year). This easing of monetary conditions, coupled with the pending liquidity provided by the budget bill (adding two trillion dollars to the federal deficit) are a cocktail investors have become accustomed to, with an added shot of deregulation promised by the Trump administration. What makes this different is that it comes at the peak of a three-year bull market. Barring any exogenous event, we would expect this trifecta to be additive to GDP and corporate earnings, a potential rationale for the elevated price-to-earnings multiple of the S&P 500. All of this points to continued “risk-on” positioning within the market.

As mentioned in our first quarter letter, one area that is important to remain vigilant of is corporate earnings. Entering the year, analysts expected S&P earnings to grow at a robust 14% year-over-year rate. Beginning shortly after the April tariff announcements, analysts lowered earnings estimates. While still a “healthy” 12%, we may not be finished with the tariff uncertainty. New trade deals are expected to be announced early in the third quarter; however, new tariffs are also expected on countries deemed not in compliance. Depending on which country (or group of countries) falls into this category, we could see further trimming of S&P earnings. This would put pressure on an already stretched multiple and could result in falling markets if coupled with any deterioration in the aforementioned fundamentals. We will continue to monitor earnings carefully.

While any one event of the first half could have struck fear in corporations or consumers causing a cessation of spending, the strength and resilience of both continue to impress. Corporate America, often quick to delay investment, continued to spend on anything surrounding artificial intelligence, or AI. With solid employment numbers, the consumer has also remained resilient. How much longer the consumer can “hang on” remains to be seen, however. From shifting spending patterns to rising delinquencies, there are cracks beginning to form. If the U.S. economy is to continue its “soft landing,” it will be important for growth to remain positive, inflation to fall and unemployment to remain low. Extension of the 2017 tax cuts in the recently passed budget bill should boost consumer confidence and provide a little added cushion for any volatility ahead.

As always, we look forward to assisting you in any way we can. Enjoy the summer.

Sincerely,

Your Oarsman Capital Team