4Q 2025 Review and Outlook

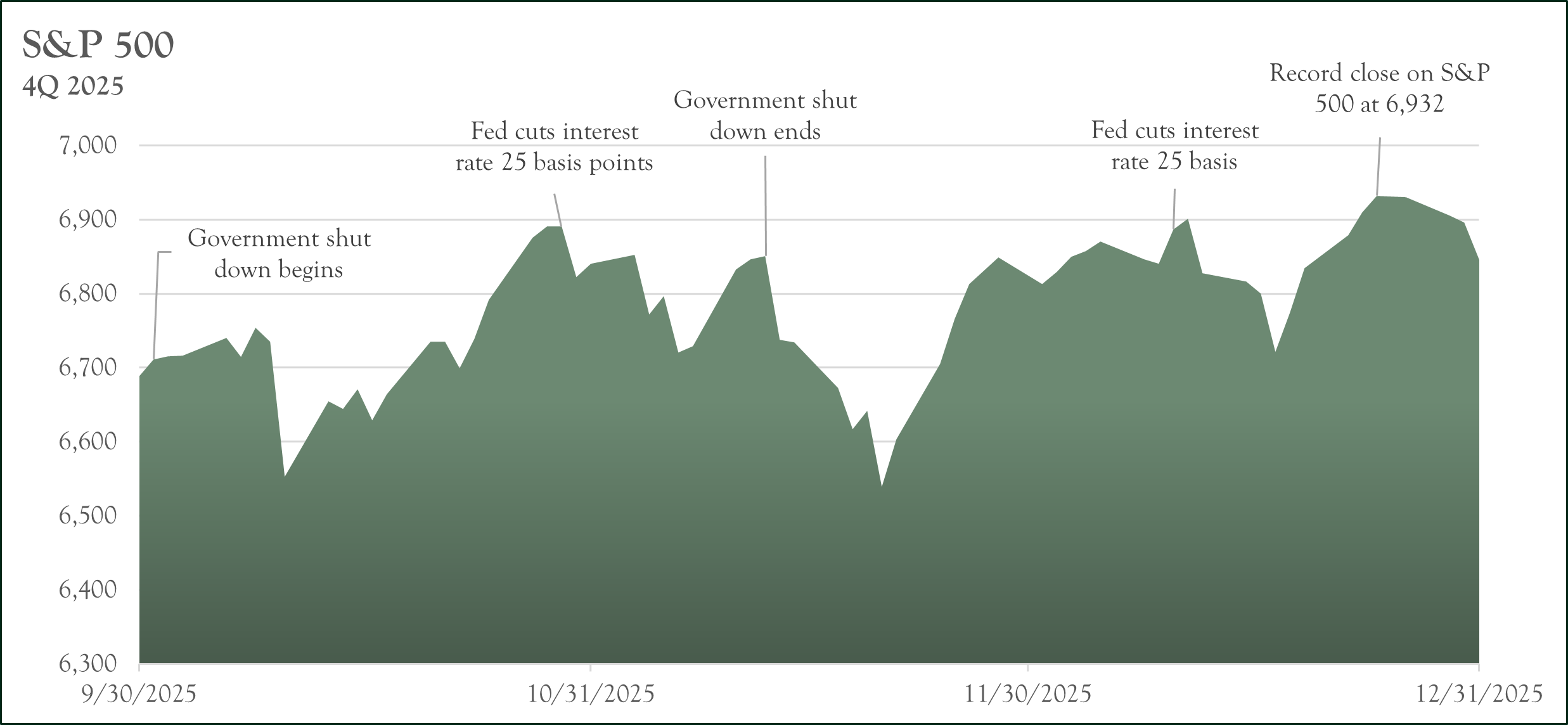

Equity markets maintained their upward trajectory despite concerns over a U.S. government shutdown and low consumer sentiment. The S&P 500 rose by 2.7% during the fourth quarter and ended 2025 with a gain of 17.9%, a third consecutive year of double-digit returns for the broad-based index. Market performance was driven by the artificial intelligence (AI) buildout, falling energy costs, interest rate cuts, and record corporate profits.

The top-performing S&P 500 sectors during the quarter were Health Care, Financials and Information Technology. In contrast, the Consumer Discretionary, Consumer Staples and Real Estate sectors lagged, with all three sectors ending the quarter in negative territory.

International equities bested U.S. stocks, with both developed and emerging markets up nearly 5%. Small-cap stocks were up roughly 2%.

Fixed income returns were generally positive, as the Fed lowered rates — boosting bond prices due to their inverse relationship with interest rates. Meanwhile, gold continued its historic run, climbing another 12% and reinforcing its role as a global safe-haven asset in uncertain times.

What drove the stock market?

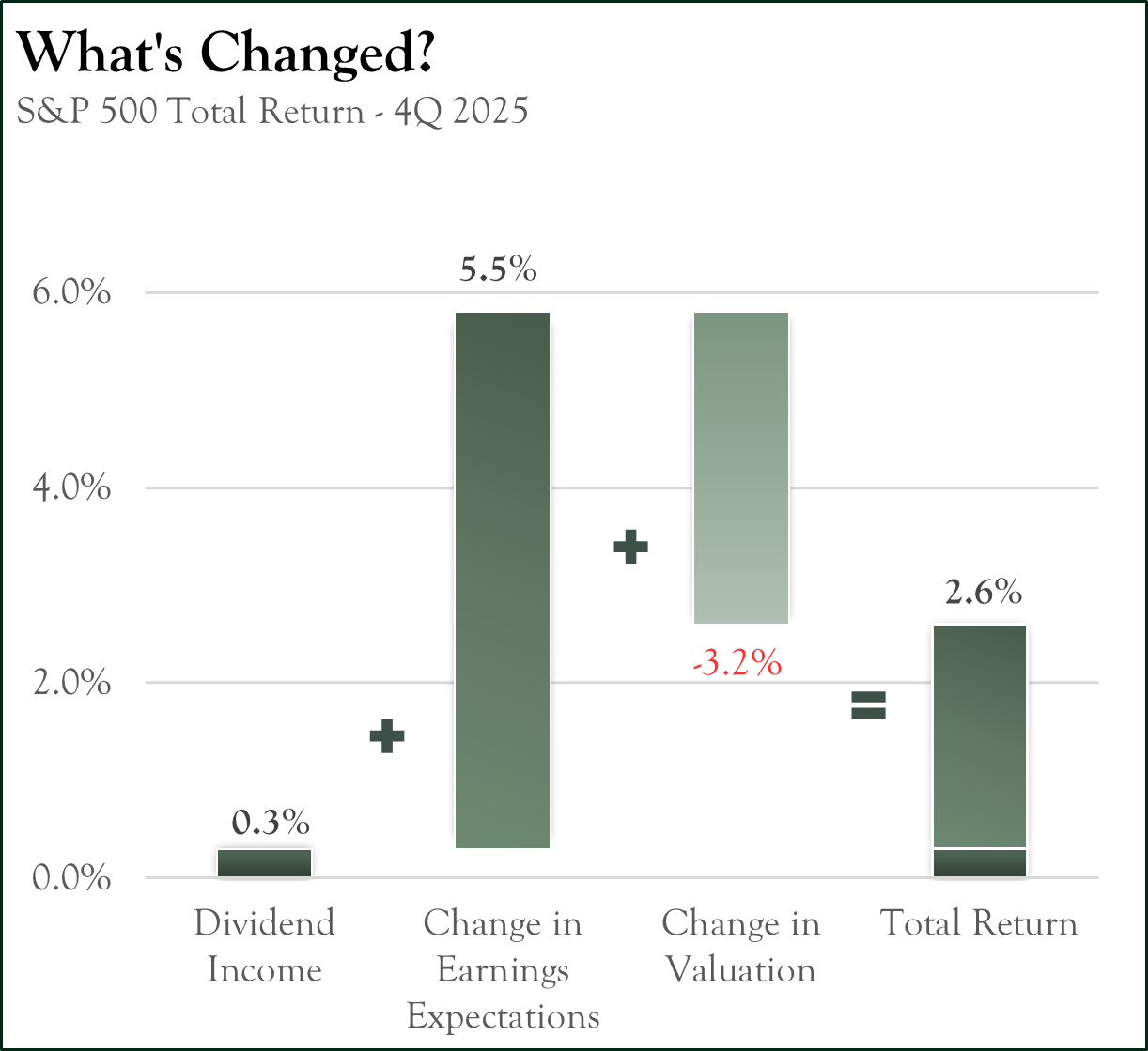

“What’s Changed?” is a simple explanation of what happened in S&P 500 during the most recent period but does not necessarily explain why the market moved. Let’s explore the “why” by looking at three individual components that shape market changes.

Dividend Yield:

The most stable of the three factors as corporations resist cutting their dividend except in the most extreme cases. Dividend yields were approximately +0.3% this quarter.

Change in Earnings Expectations:

Over the long term, earnings drive stock prices. This quarter, earnings expectations for the next 12 months rose by +5.5%, continuing the very strong trend. Tax breaks and benefits from the continued AI capital investment boom spread across the economy into various sectors and helped drive upward revisions in earnings.

Change in Valuation:

Earnings growth in the fourth quarter was met with lower consumer confidence and geopolitical uncertainties (including our U.S. government shutdown) which helped dampen valuations from fairly high levels during the quarter. For this calculation, we measure change in valuation in the price-to-earnings (P/E) ratio. This quarter, the P/E ratio responded to the sentiment and uncertainties, contracting by -3.2%, after beginning the quarter at a lofty 22.8 times earnings. The slightly less buoyant enthusiasm may be a sign that investors are becoming doubtful of another year of double-digit earnings growth in 2026. At 22.1 times earnings, valuations are still high by historical standards, and earnings will need to continue to stay strong for the valuations to hold up.

What drove the bond market?

After a nine-month break, the Federal Reserve continued its easing cycle with two additional rate cuts in the fourth quarter, lowering the Federal Funds Rate to a range between 3.50% and 3.75%. Market pundits offer various viewpoints into the Fed’s future actions – either focusing on inflation which would prevent or limit future cuts or a weaker employment environment that supports additional cuts.

The 2-Year Treasury moved lower to close the quarter at 3.5% compared to the end of the third quarter at 3.6%. Movement in the 10-Year Treasury Note was muted, closing the quarter up by a few basis points.

During the quarter, discussion continued as to who might be the next Chair of the Board of Governors at the Federal Reserve System. Powell’s term as Chair is set to end in May of 2026 (though his term on the Fed’s Board of Governors doesn’t expire until 2028). While the tenure of Jay Powell continues to be headline news, most policy makers at the Fed see higher probabilities of a lower Fed Funds Rate – possibly one to two rate cuts in 2026.

The Federal Reserve cut its benchmark interest rate twice in the quarter, lowering the Federal Funds rate to a range of 4.25 to 4.50 percent. Despite the Fed cutting short-term rates, however, the yield on the 10-Year Treasury rose from 3.8 percent to over 4.5 percent. There are several possible explanations for this upward move. To begin, inflation has remained stubbornly above the Fed’s target of 2.0 percent. Fed Chairman Jerome Powell has stated that the Committee is closely watching for signs that inflation could be re-accelerating. Higher inflation in the economy has an upward bias on interest rates and rates drifting higher could be an indication that the market is pricing in this possibility. If that is the case, the Fed would be forced to pause (or possibly reverse) their current rate-cutting cycle. Another possible explanation is the incoming administration’s focus on lowering taxes and deregulation - both potentially expansionary policies. The re-rating of growth expectations upward translates into higher long-term interest rates as bonds are sold (lower price, higher yield) in favor of higher return-potential equities. Either reason, or a combination of the two, leads to higher rates in the future.

Outlook

The U.S. economy is experiencing an alignment of fiscal stimulus and monetary easing, creating a tailwind for GDP growth. On the fiscal side, the full implementation of the One Big Beautiful Bill Act (OBBBA) is providing a significant injection of liquidity by making the Tax Cuts and Jobs Act (TCJA) permanent and introducing several incentives for corporations, translating into a capital expenditure boom. On the other side of the ledger, monetary policy is moving to a more accommodative stance as the Federal Reserve looks to continue its rate cutting cycle into 2026. This coordination is crucial as fiscal policy stimulates demand and encourages domestic re-shoring through business tax incentives; the Fed’s easing lowers the cost of capital needed to fund that expansion. Fiscal policy stimulating growth with a cooperative Federal Reserve has the effect of running the economy “hotter” than previously accepted, making way for more cyclical parts of the economy to do well (e.g., industrials, financials).

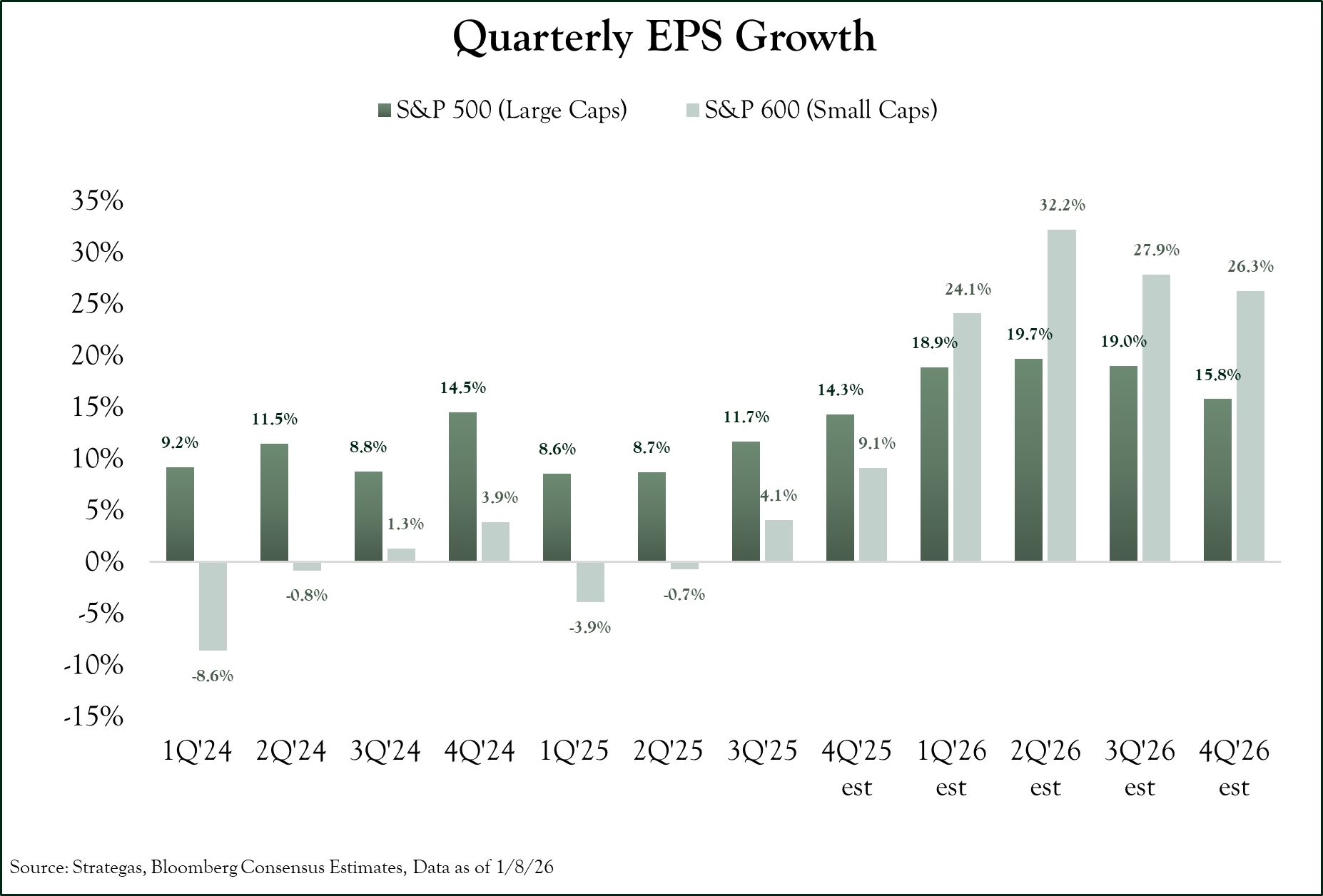

After years where the "Magnificent 7" carried the weight of the entire market, 2026 is projected to be the year where the market meaningfully broadens out. We are expecting a handoff in leadership as earnings growth finally moves down the market capitalization spectrum and into the broader economy. This transition is being driven by a fundamental shift in the macro environment. While mega-cap tech was the safe-haven for a high-rate world, the current environment of neutral (if not accommodative) monetary policy and domestic reshoring is a specific catalyst for the "other 493" companies in the S&P 500, as well as mid- and small-cap stocks. As borrowing costs drop, the heavy interest-expense burden that previously stifled smaller firms is lifting, unlocking significant free cash flow for domestic expansion. As seen in the chart, earnings from small-cap companies are expected to grow at a faster rate than large-caps throughout 2026. Consequently, we believe the market will no longer be defined by the singular dominance of a few tech giants; it will be defined by the return of the “rest” of the market, offering investors an opportunity to capture high-quality growth at more attractive valuations.

While the alignment of fiscal and monetary policy provides a fertile backdrop for corporate earnings, a starker reality is unfolding at the household level. The "K-shaped" economy referenced ad nauseam in financial media is real and getting worse. At the upper end of the spectrum, high-net-worth households continue to benefit from a "wealth effect" cycle. These consumers have successfully converted higher interest rates into significant returns on cash reserves and fixed-income portfolios, while also seeing their home equity and stock portfolios reach record highs. Conversely, the lower and middle tiers of the economy are grappling with a persistent squeeze. Though the inflation of previous years has cooled, the Consumer Price Index (CPI) remains "sticky," registering 2.7% YoY in November 2025. For the average consumer, the Fed’s inability to return inflation to its 2.0% target or, more significantly, induce outright disinflation, means that the cost of non-discretionary essentials has likely reset at a higher plateau. However, this mounting pressure is being met with a significant offset in 2026. As highlighted in a previous letter, the OBBBA signed last July is set to act as a liquidity bridge. Due to the expansion of standard deductions and the introduction of specific household tax credits, the average tax filer is expected to receive nearly $1,000 more in their tax refund this spring compared to last year. We believe this is a pivotal catalyst for the 2026 market. For a consumer base that has been leaning on credit to maintain their lifestyle, this injection of liquidity should provide immediate, albeit temporary, relief to personal budgets. While this may be a short-term buoy rather than a permanent solution, it provides the necessary momentum to sustain the current economic expansion through the fiscal year.

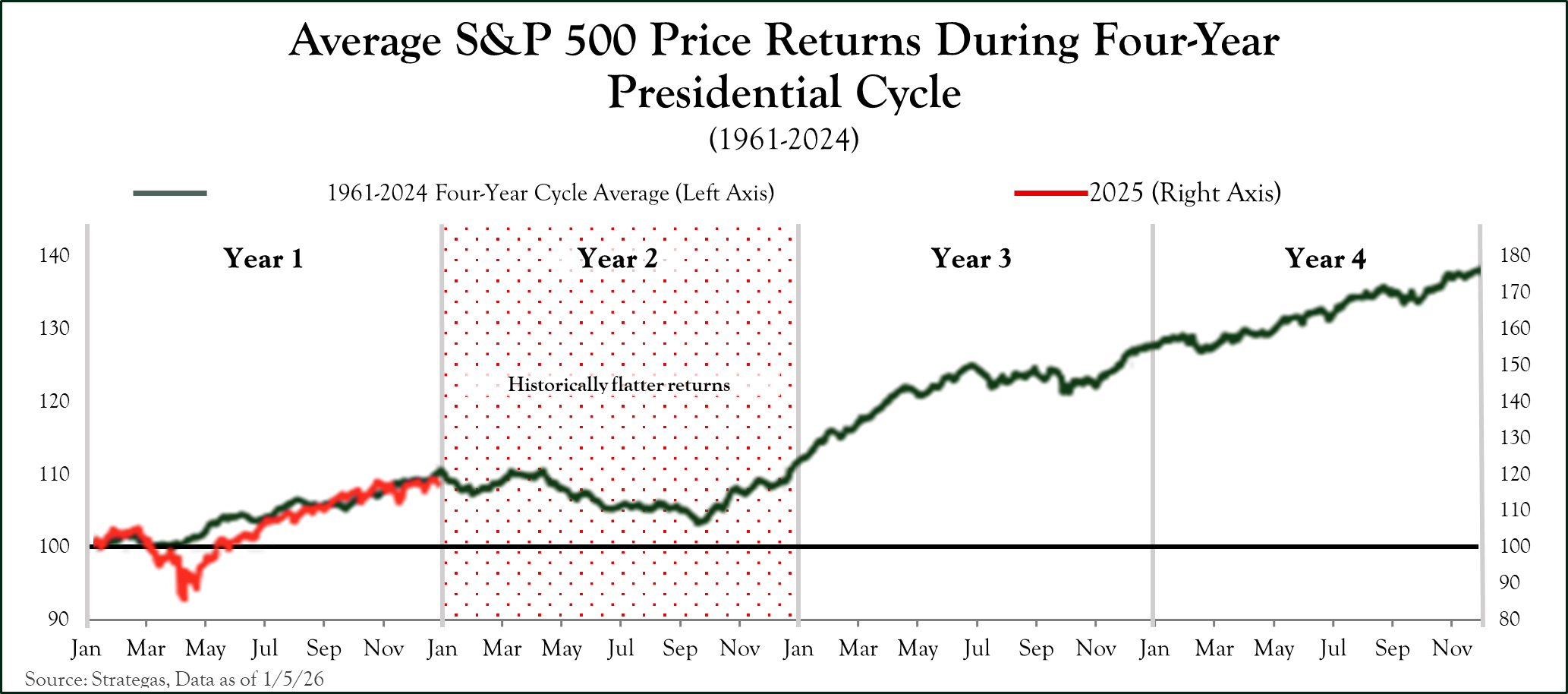

One “seasonal” factor to be aware of as we move into 2026 is our current position with the four-year Presidential cycle. While potentially pushing the limits of what is “statistically significant” (as the sample size is only 16), research from Strategas has observed that stock market performance in the second year of a Presidential cycle has been more muted than years one, three, or four. Coupled with historically middling performance, mid-term election years also tend to introduce greater volatility. Given anecdotal data sets like these, we will look for buying opportunities on any weakness throughout the year driven by news headlines yet unsubstantiated by the underlying data. The facts are that fiscal and monetary harmony are a powerful force that make it very difficult to be negative on the broader market. Everything else is just noise.

Outside the U.S., gains in the international markets were exceptionally strong in 2025. After several years of significant under-performance relative to the U.S., mostly tied to mega-cap technology stocks, international markets posted their strongest performance since 2009. While a portion of those returns were tied to currency effects (as a weaker U.S. dollar can help boost returns when gains are translated back into U.S. dollars), we do see signs of a paradigm shift in many markets. Years of austerity have suffocated European equities; however, many in the EU are now committing to increasing defense spending, specifically Germany. While the reasons behind this increase are sub-optimal, it has had, and will continue to have, a positive impact on many related industries. And it’s not only Europe. In Japan, fiscal policy was shifted towards expansion, with governmental stimulus injecting trillions of yen, lifting the entire market. Lower equity valuations in these markets coupled with strong earnings growth and a little (or a lot of) government help, should have a positive effect on equity prices, regardless of currencies.

Of course, geopolitics is always high on any list of risks to the market. As of the writing of this letter, there are new details emerging regarding Venezuela, Greenland, Russia and China. The market, however, seems to be taking these developments in stride. All we can add here is that unknowns are always lurking. The first step is to accept that reality and then move forward developing diversified portfolios; relying on data not, headlines; and reacting when the facts change. We look forward to speaking with each of you in the coming days, weeks and months.

Happy New Year!

Sincerely,

Your Oarsman Capital Team