An investment plan built for you

We assess your financial position, clarify your objectives, and develop a plan that works for you.

At the outset of each relationship, we take particular care to understand your investment objectives, preferences and constraints. We then construct and manage a Core+ investment portfolio tailored to meet your needs across multiple economic and market environments.

The term Core+ refers to individual stocks and bonds (the “core”) augmented by additional assets (the “plus”).

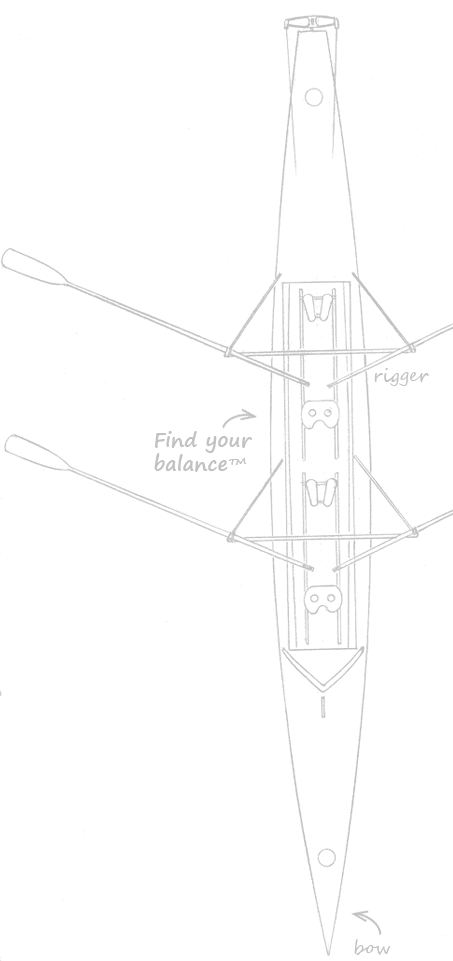

Our Core+ approach

Our Core+ customized portfolios typically hold a broad mix of individual, high-quality domestic common stocks and investment-grade-rated individual bonds. We further enhance the diversification and performance potential of the equity allocation by adding complementary asset classes, such as international, small-cap, and emerging market stocks (or stock-based funds). We also complement individual bonds with fixed-income ETFs and actively managed funds to help reach our target duration (a measure of interest rate sensitivity).

To refine the portfolio’s risk-return balance, we add exposure to alternative/hybrid investments. These assets have historically low correlation with traditional stocks and bonds, though they share some characteristics with them. Holdings may include preferred stocks, high-yield bonds, inflation-protecting bonds, real estate, natural resource securities, and private equity/credit products.

More about Core+ investment selections

Equities

We build broadly diversified portfolios with investments in companies vetted to meet specific investment characteristics, including capital growth potential and consistent dividend income. Equity categories may also include diversified stock-based funds (e.g., exchange traded funds or ETFs) for exposure to domestic stocks, as well as small-cap and international stocks.

Fixed-income

We consider fixed-income securities to be a portfolio stabilizer, providing predictable income streams while acting as a cushion against volatility. Our fixed-income portfolios generally hold average bond ratings of A or better with intermediate portfolio duration. Fixed-income funds, when utilized, offer diversification and yield.

Risk control

We firmly believe that controlling investment risk is essential to achieving superior long-term results for our clients. Portfolio balance and prudent diversification are integral to our risk-controlling approach. This approach has proven successful in helping to preserve capital in challenging investment environments while providing potential appreciation in less volatile periods.

Know what you own

Prudent investing requires an understanding of what you own. Oarsman’s security selection enables us to tailor portfolios to individual client preferences, such as including or excluding securities of a specific issuer or industry.